How can impact investors manage negative impacts?

By Ben Constable-Maxwell, M&G Investments, as part of Tenet Compliance Services Adviser Development Programme

Fund managers need to be aware of unintended negative consequences of their investments, even when the fund is designed and managed exclusively to target positive impact. As impact investors, we need to take measures that proactively reduce the risk of negative impacts being generated from these investments, and, where peripheral negative impacts may occur, work hard with portfolio companies and other stakeholders to actively address these issues.

Do positive impact investors have to accept unintended negative sustainability outcomes – also described as 'trade-offs' or negative externalities – from their investments? Or can they effectively mitigate these negative outcomes via intentionally managing them in the impact investment process?

This article sets out how, for M&G’s public equity impact funds, we incorporate the critical concepts of 'net impact' or 'impact balance' in our impact investment approach, and how we manage our impact portfolios to help avoid, minimise and mitigate potential negative impacts.

Targeting positive impact via solutions

Every business has an effect – or impact – on the world. In simple terms, companies can either contribute to societal goals or detract from them. In turn, investors can choose to invest in companies whose overall impact is either positive or negative. Investing for positive impact is not an exact science; and yet a robust process, rigorous analysis and a focus on evidence can help to ensure the overall portfolio is focused on positives and avoids negatives.

Our approach in M&G's equity impact team targets companies seeking to make a significant and intentional positive impact on critical social and/or environmental challenges, ranging from climate change and pollution to poor health and social exclusion. While a company’s operations, actions in the community or treatment of its workforce can all play a societally beneficial role, the main impact most companies can achieve is via the role of their core business in tackling the world's major challenges. An example would be a company whose core business is the generation of clean energy, rather than one simply reducing its own carbon footprint; or a company providing access to communications that can drive economic empowerment for vulnerable groups, rather than a company simply improving the diversity of its board.

So, our approach naturally focuses on 'solution-providers'. To identify such companies, our approach starts with a particular challenge, be it global warming, excessive waste or lack of access to healthcare, and then seeks out companies whose core business is directly tackling the issue. Materiality (or 'significance') is an important concept for us (as well as in the field of impact investing more broadly), so we look to find companies where the significant majority of the business, usually indicated by its revenues, is focused on the solution in question.

This part of our approach – identifying genuinely positive impact solution-providers – requires a lot of work, but is logical enough. However, we also want to ensure that the companies we invest in are not having – nor likely to have – a significant negative impact on other social or environmental factors. This deepens our analysis and ensures the net or overall impact is clearer and stronger.

Considering 'net impact'

It would be difficult to justify the case for a company that is creating a solution to address climate change but causing significant harm to natural ecosystems, or a company that manufactures life-saving treatments but uses forced labour in its supply chain to produce them. We think of this conceptually as 'net impact' or 'impact balance', whereby the impact of companies we invest in needs to be significantly positive overall, with any minimal negatives being outweighed by the positive impact generated.

We do need to recognise that it is effectively impossible to identify a company that has zero negative impact. However, companies with a clear and authentic purpose to tackle global sustainability challenges tend to naturally minimise their negative impacts, or are otherwise open to working with their stakeholders to reduce them. We think of these as 'net positive impact' businesses.

The 'netting off' of impact should not be thought of as a mathematical equation, nor should it be an excuse to permit significant negative impacts just because of the primary positive impact. But it is a useful concept to focus on with businesses where the overall impact is overwhelmingly positive, while also intentionally identifying and working on areas for development and improvement.

Addressing negative impacts

We employ a number of steps to identify, avoid or manage any actual or potential negative impacts in our impact investment approach. These are built into our ‘III’ (Triple I) approach, which focuses on Investment, Intention and Impact.

Exclusions

The first step is to apply rigorous screening, which enables us to rule out companies exposed to activities highly likely to cause significant harm, i.e. those operating in inherently unsustainable sectors such as tobacco, alcohol or fossil fuel extraction, or companies breaching norms and standards of sustainable and ethical business. This extensive exclusion list, covering both values and norms-based screens, plays a critical first-line role in avoiding negative impacts. It may restrict our investable universe, but it minimises our exposure to negative impacts and aligns our investments with the high expectations of our clients.

ESG integration

ESG analysis is a central aspect of our investment approach and is designed to identify and mitigate our exposure to sustainability risks. By systematically analysing potential investments, we build our understanding of challenges the company may be exposed to and how it is managing those risks. As well as analysing the company's own operations, we also consider its supply chain, as this is where egregious activities can sometimes be hidden. Companies that fail to meet our standards for ESG risk management will not make it through this stage of the process.

Tesla would be an example of a transformational solution to a systemic problem (unsustainable transport), but which failed our analysis on a number of ESG issues, including corporate governance and supply chain sustainability. While the Environmental and Social aspects of ESG are most naturally linked to our impact objectives, our focus on Governance also plays a crucial role in helping us to understand the business's purpose, whether its management are incentivised to deliver that purpose, how the board balances the interests of shareholders with other stakeholders, and whether the company has the right controls in place to effectively guide the company’s mission.

Negative impact analysis

In the same way that we analyse our investments for the positive impacts they generate, we apply a similar lens to any negative impacts. For our positive impact assessment, we look at the revenues being generated from positive impact activities. In the same vein, we assess how material any negative impacts are to the company's business model. If the negatives are of significance, this would rule out the company as a potential investment. This may best be illustrated by way of several examples:

- We analysed Finnish refining business Neste, which produces renewable biodiesel (a 'positive impact' activity) as well as conventional refined oil products ('negative impact'). With renewable biodiesel products representing only 25% of total sales, the company was evaluated as having a negative net impact footprint. Another way of analysing the situation is by assessing the net carbon footprint. In this case, the balance was also skewed to the negative, with more CO₂ emitted from the negative activities than CO₂ avoided by the renewable diesel business. This resulted in the company failing our impact assessment, although we continue to monitor the impact balance as Neste grows its renewables business.

- In the case of financials, we have analysed selected emerging market financial service providers. We consider revenues from affordable banking products and insurance coverage for low-income customers as being positive impact; while on the negative side, lending practices to unsustainable activities such as coal mining or agricultural activities linked to deforestation would be considered negative impact. We have ruled out a number of potential investments due to exposure to the latter.

Within our Impact analysis (the third ‘I’ of our III), as well as assessing any actual negative impacts, we also focus on potential negatives or impact risks. We use the framework designed by the Impact Management Project (IMP) which covers nine different types of impact risk that may undermine the delivery of the impact. These range from ‘evidence risk’ (lack of sufficient data to understand the impact occurring) to ‘execution risk’ (the risk that the activities are not delivered as planned) to ‘unintended impact risk’ (the risk that a significant negative impact is experienced).

Engagement

As active impact investors, we use engagement to encourage improvements to the ‘net impact’ and provide additionality. By engaging with investee companies, we can encourage greater positive impact, request more comprehensive data disclosure, or take steps to manage or reduce potential negative impacts. For example:

- We engaged with stone wool insulation producer Rockwool, in the wake of community protests over pollution at the company’s facilities in Ranson, West Virginia. We met with the Director of Sustainability to request improved disclosure of its remediation efforts, community engagement processes and air quality monitoring. An investigation showed that there was no discernible risk to public health, but Rockwool failed to carry out adequate risk-based due diligence, and did not consult the local community during the construction of the facility. The company’s remediation efforts included publishing daily air quality data on a publicly available website, and creating an online forum for local residents to voice their concerns, as well as informing the local community of updates via email and social media. Rockwool also acknowledged that internal due diligence processes must be strengthened, and is developing a comprehensive public engagement programme to enhance two-way communication with local communities in the future.

- We asked waste management firm Republic Services to set a target for net zero emissions by 2050, and to increase its target of 35% lower emissions by 2030. The company is currently prioritising its 2030 target, and is aiming to cut emissions by electrifying its fleet of collection trucks and capturing methane when it is emitted from landfill sites – both of which are outcomes of increased capital expenditure in these areas.

Why does this matter?

We believe that a positive impact balance is an important aspect of any impact investment strategy. It doesn’t make sense to play ‘whack-a-mole’ by aiming to tackle one societal problem while simply exacerbating another one. This is why we analyse the actual and potential negative impacts of companies, while also considering the impact risks. We do this before investing in companies, but also on an ongoing basis for companies held in our impact funds.

However, it remains important to recognise that the answer is never simple, and it is impossible to avoid all negative impacts. For example, the emissions generated in the production of climate solution products clearly release greenhouse gas emissions into the atmosphere. But the question for us is: how significant are these emissions, what is the company doing to reduce or mitigate them, and are they more than counterbalanced by the emissions-saving potential of the product itself?

By carrying out this analysis, we can direct capital towards investments which aim to make measurable, intentional, and truly positive impacts on the world’s most pressing challenges.

The value of the fund's assets will go down as well as up. This will cause the value of your investment to fall as well as rise and you may get back less than you originally invested. The views expressed in this document should not be taken as a recommendation, advice or forecast.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

The M&G Sustainable Multi Asset Fund Range - A range of sustainable, multi-asset, risk-targeted solutions

By Maria Municchi, M&G Investments, as part of Tenet Compliance Services Adviser Development Programme

The value and income from the funds' assets will go down as well as up. This will cause the value of your investment to fall as well as rise. There is no guarantee that the funds will achieve its objective and you may get back less than you originally invested.

Our Sustainable Multi Asset range represents a key suite of funds for us in the UK, in a world increasingly adept to sustainable investment choices. M&G has long recognised that many clients want their investments to go beyond seeking attractive financial returns. They want their savings invested responsibly, and to have the opportunity to participate in making a difference to the world’s future. Tackling the effects of climate change and the desire to improve society for the greater good are increasingly driving the need for sustainable solutions.

Our Sustainable Multi Asset Fund range launched in late 2020 with the aim of furthering these goals by investing across a wide spectrum of asset classes globally. The funds are designed to align financial and sustainable goals; we develop and leverage global asset allocation views to build portfolios that deliver attractive investment returns, aligned with the financial objectives of our clients in line with desired sustainability outcomes.

Away from the investment floor, M&G continues to underline its broader commitment to ESG and sustainability-focused investing as a firm:

- We have pledged to decarbonise our business and set a target to become carbon net zero by 2030.

- We are aiming to reach carbon net zero across our investment portfolios as an asset owner and asset manager by 2050, in line with the Paris Agreement and the UK Government’s own target.

- As a firm, we believe that ESG and sustainable investing criteria are increasingly going to be key drivers of returns for many companies and markets moving forward.

- This isn’t about M&G jumping on the green investing bandwagon; we believe we can harness our skillsets and scale to target investments that can genuinely make a difference to the world.

M&G is increasingly transitioning its fund range to include sustainable outcomes as part of an investment objective, reaffirming the company’s strategic decision to meet our clients’ growing demand for sustainable investment products.

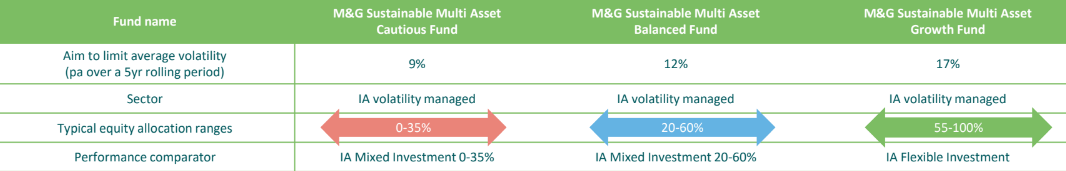

The Fund Range

The funds employ a sustainable investment approach that seeks to generate returns over the long-term while seeking to maintain the volatility of those returns to set ceilings measured over any five-year period. Returns are combination of income and capital growth, achieved through flexible asset allocation and guided by a robust valuation framework.

ESG factors are incorporated into the portfolio construction phase via ESG screens to identify our investable universe. We seek to invest in assets issued by companies or governments that uphold high standards of ESG behaviour.

- As well as seeking investment return, each fund is expected to meet the following non-financial metrics:

o Minimum MSCI ESG rating of A-AA

o Carbon intensity level lower than the MSCI AC World Index

o A ‘positive impact’ assets exposure of between 20 and 50% of NAV. These are companies or institutions that seek to actively address some of today’s big environmental and social challenges alongside their commercial obligations.

Within portfolio construction we adopt a mixture of both long term, top-down asset allocation decisions and a more tactical decisions that seek to exploit mispriced opportunities across asset classes. Macro and sustainability developments, assets behaviour, investor psychology are all examined.

The manager assesses what is considered to be fair value for a wide range of global assets (bonds, credit, equities, real estate, cash, infrastructure) around the world in light of historical expected returns, economic theories and investors’ preferences for each asset class.

This is called ‘neutrality’. She then compares this neutrality with the real yield of these assets to create a robust valuation framework (see chart below). The objectivity and discipline of this analysis helps to prevent the fund manager from falling victim to the very emotional biases she looks to exploit.

Reasons to invest

- As at 31 March 2023, each fund’s MSCI ESG score (covering holdings that are rated by MSCI) was between 7.2 (the Cautious fund) and 8.0 (the Growth fund). This is equivalent to an MSCI ESG rating of AA.

- Well over 40% of fund holdings across the range were classed as ‘positive impact’ assets. Included in this bucket are positions in infrastructure, notably in selected companies focused on renewable energy strategies, as well as other impact assets such as green bonds.

- Geopolitical events in 2022 have hastened the energy transition for many nations as policymakers began work to improve their energy security and diversify their energy sources, putting renewable power firmly on the agenda of many governments and global companies.

- Recent government initiatives such as REPowerEU and the Inflation Reduction Act in the US are directing billions of dollars of funding towards new energy technology and green initiatives.

Risks associated with investing

The main risks that could affect performance are set out below:

Investments in bonds are affected by interest rates, inflation and credit ratings. It is possible that bond issuers will not pay interest or return the capital. All of these events can reduce the value of bonds held by the funds.

The funds are exposed to different currencies. Derivatives are used to minimise, but may not always eliminate, the impact of movements in currency exchange rates.

Investing in emerging markets involves a greater risk of loss due to greater political, tax, economic, foreign exchange, liquidity and regulatory risks, among other factors. There may be difficulties in buying, selling, safekeeping or valuing investments in such countries.

The funds may use derivatives to profit from an expected rise or fall in the value of an asset. Should the asset’s value vary in an unexpected way, the funds will incur a loss. The funds' use of derivatives may be extensive and exceed the value of its assets (leverage). This has the effect of magnifying the size of losses and gains, resulting in greater fluctuations in the value of the funds.

In exceptional circumstances where assets cannot be fairly valued, or have to be sold at a large discount to raise cash, we may temporarily suspend the funds in the best interest of all investors.

The funds could lose money if a counterparty with which it does business becomes unwilling or unable to repay money owed to the funds.

Operational risks arising from errors in transactions, valuation, accounting, and financial reporting, among other things, may also affect the value of your investments.

Further details of the risks that apply to the funds can be found in the funds' Prospectus at www.mandg.com/ investments/professional-investor/en-gb/literature.

Sustainability criteria for the range can be found at the following links:

M&G Sustainable Multi Asset Balanced Fund Sterling I Acc

Electric vehicle batteries – controversies and solutions

By Jermaine Mensah, M&G Investments, as part of Tenet Compliance Services Adviser Development Programme

With road transport producing 16% of global emissions according to the IEA, the widespread adoption of electric vehicles (EVs) will be essential in global efforts to reach net zero. And yet, despite the sustainable credentials of EVs, there remain several environmental and social controversies around their production. Here, we review the main controversies in the EV battery value chain and the potential solutions.

The anatomy of an EV battery

Most EVs run on Lithium-ion (Li-ion) batteries – the same type of battery used in laptops and smartphones. The performance of batteries, including energy density (vehicle range) and the safety (flammability), is determined by the chemistry, with all chemistry mixes exhibiting different performance characteristics. For instance, Lithium Nickel Manganese Cobalt Oxide (NMC) batteries have high energy density due to the cobalt content of the cathode, which supports better driving distance range.

EV batteries work by circulating electrons, creating a difference in potential between two electrodes – one negative (the ‘anode’) and one positive (the ‘cathode’). These are immersed in a conductive liquid called the electrolyte. When the battery is powering the vehicle, electrons travel from the anode to the cathode, and vice versa when the battery is charging.

Anodes are usually made from graphite, whereas the electrolyte is a lithium salt in the form of a liquid or gel. The cathode is made from lithium metal oxide combinations of cobalt, nickel, manganese, iron and aluminium, and its composition largely determines battery performance.

Ethical problems in the supply chain

Cobalt gives vehicles the range and durability needed by consumers. EV batteries are the highest drivers of cobalt demand, consuming 34% of global capacity in 2021 (according to The Cobalt Institute). As EVs become more common, the European Commission and the Global Battery Alliance forecast a fourfold increase in cobalt demand by 2030.

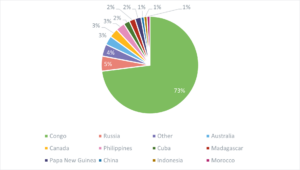

The sourcing of cobalt is closely tied to ethical controversies linked to child labour and slavery, which is arguably the most prominent issue when it comes to the EV battery landscape. The Democratic Republic of Congo produces more than 70% of cobalt globally, with 15-30% of mining production capacity attributable to artisanal and small-scale mining (ASM). This makes cobalt production from ASM the second largest cobalt-mining sector in the world after LSM (large-scale industrial mining) production in the DRC. ASM has been linked to child and slave labour, and UNICEF estimates that more than 40,000 children currently work in the artisanal and small-scale mines.

As widespread adoption of EVs continues, cobalt mined from artisanal miners is mixed into the EV production value chain. It is impossible to determine how much of the EV battery production pumped out today is linked to artisanal miners, but it is safe to say this is a major ethical controversy that persists.

Where does cobalt come from?

Source: United States Geological Survey and Bernstein analysis, 2022.

Environmental damage from mining

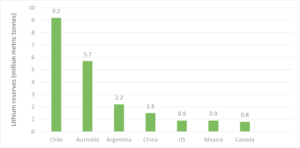

Alongside the social controversies, there are also environmental issues from the extraction of key minerals such as lithium and nickel. According to McKinsey & Co, growing electric vehicle use is expected to increase lithium production by approximately 20% a year this decade, and by 2030, EVs will account for 95% of lithium demand.

Lithium is extracted from either hard rock or underground brine reservoirs. Hard rock extraction produces 15 tonnes of CO2 emissions per tonne of lithium, and leaves scars on the landscape. It has also been linked to water contamination in Tasmania, an Australian mining hub.

Brine extraction creates 5 tonnes of CO2 emissions per tonne of lithium. It is a water-intensive process – seawater and other surface water are mixed with freshwater and left to sit in ponds for up to 18 months, leaving behind minerals as the water evaporates. The practice has been linked to water shortages in Chile, where water availability has dropped to 10-37% over the past 30 years, and is forecast to get worse.

Lithium reserves are concentrated in Latin America and Australia

Source: United States Geological Survey, MineSpans, 2022.

Nickel is a key element used in the chemistry mix for Nickel Manganese Cobalt (NMC) and Nickel Cobalt Aluminium (NCA) Li-ion batteries, which contain 33% and 80% nickel respectively. Nickel mining has the highest emissions intensity of all metals, producing an average of 10 tonnes of CO2 per tonne of metal. The practice has also been linked to increased deforestation and the contamination of local rivers and lakes in Indonesia, which has the world’s largest nickel reserves.

Safety concerns

In the same way that smartphone batteries can get hot when charging, EV batteries are naturally prone to overheating. Of course, this poses serious health hazards or potentially life-threatening risks to the end user if the batteries catch fire.

This has led to a number of high-profile product recalls. For example, General Motors recalled 73,000 Chevrolet Bolt cars after at least 13 vehicles caught fire due to ‘rare manufacturing defects’. Hyundai also recalled 74,000 of its Kona EVs after 16 of them caught fire. In both cases, the batteries were produced by LG Energy Solutions (LGES).

However, it is important to bear in mind that the recalls are immaterial in comparison with the millions of units sold by LGES each year. Furthermore, recalls for safety reasons are not so uncommon, and were occurring for internal combustion engine vehicles before EVs. As an example, in 2022, Volkswagen and Audi recalled more than 225,000 vehicles due to safety concerns over faulty tire pressure monitoring systems.

What are the potential solutions?

The EV battery production industry is in its early days, and is constantly evolving. While there is no one-size-fits-all option, there are various potential solutions to each of these controversies. Here, we explore some of them in more detail.

Recycling

Battery recycling will play a key role in improving the ethical and environmental impacts of the EV battery supply chain. 2030 is anticipated to be the year that we see an influx of recycled batteries pumped back into the supply chain, as batteries manufactured between 2017-22 finish their 10-year life cycle.

It’s difficult to put a number on expected recycled percentages, as regions have different targets and regulations. Currently, within the EU, the recycled content of batteries is only 12 % for aluminium, 22% for cobalt, 8 % for manganese, and 16% for nickel. However, with new EU regulations these numbers are set to increase (see below for more information). Research from Goldman Sachs estimates that more than 50% of lithium and nickel in the European EV market will come from recycled batteries by 2040.

It is worth noting that recycling rates will also depend on battery chemistry, with some easier to recycle than others. Furthermore, many batteries have been designed without consideration for recycling, and it can be difficult to extract the raw materials. A lack of recycling regulations prior to 2020 meant that manufacturers had no incentive to make their batteries easily recyclable.

The evolving regulatory landscape

Evolving regulations will be essential to overcoming the social and environmental problems. The EU has proposed a set of regulations to encourage greater recycling and environmental transparency. It includes quotas for minimum recycled content of new batteries – at least 12% of cobalt, 85% of lead, 4% of lithium, and 4% of nickel must come from recycled sources.

The regulation also includes new targets for recovering used batteries. For waste portable batteries, this is 45% by 2023, 63% by 2027 and 73% by 2030, and for ‘light means of transport’ batteries, this is 51% by 2028 and 61% by 2031. Furthermore, EV manufacturers must declare carbon footprints and comply with maximum lifecycle carbon footprint thresholds.

In the US, the almost-$400 billion Inflation Reduction Act legislation offers EV manufacturers tax credits if at least 50% of components are manufactured or assembled on US soil, or if at least 40% of the battery mineral contents are extracted, processed or recycled in the US or countries which have a free trade agreement with the US. This is expected to promote a better domestic supply chain for EV batteries, with a greater ability to understand and track the source of raw materials, and reduce reliance on countries with human rights issues.

Other battery technologies

There are alternative battery chemistries emerging, which negate the above problems to varying extents. It’s important to note that there is not yet an alternative to Li-ion batteries with equal energy density, which can be rolled out commercially at scale. Energy density determines the EV’s range – so this will be a crucial challenge to overcome if we are to see alternative batteries take dominant positions in the global market. However, some of the most promising contenders are:

Lithium-iron-phosphate (LFP)

LFP batteries are becoming popular in EVs from European manufacturers. They contain no cobalt, instead using iron and phosphate, which are cheaper, more abundant materials. The batteries have less energy density, but better thermal safety than Li-ion batteries. Tesla now uses LFP batteries in its standard Model 3 and Model Y cars, which have lower range requirements.

Sodium-ion (SIB)

This early-stage technology is not yet commercialised. It uses aluminium, and sodium, which is more than 1,000 times as abundant as lithium. However, SIB batteries have less energy density/vehicle range than Li-ion batteries, and are heavier, making them less suitable due to their considerable size.

Solid-State

At a very high level, solid-state batteries use a solid electrolyte as opposed to the liquid or polymer gel found in current Li-ion batteries. This can take the form of ceramics, glass, sulphites or solid polymers. These batteries do contain cobalt, but much lower amounts than Li-ion batteries, and offer advantages for power density and lower risk of fire. Many manufacturers, including Toyota, Samsung and LGES, are aiming to reach commercialisation for solid-state batteries over the next few years.

In conclusion

EVs will undoubtedly help to decarbonise the global economy, and their widespread adoption will play an integral role in efforts to reach net zero emissions. However, while the industry is continually evolving, there remain fundamental social and environmental issues which must be tackled.

The value of investments will fluctuate, which will cause fund prices to fall as well as rise and investors may not get back the original amount invested.

For financial advisers only. Not for onward distribution. No other persons should rely on any information contained within. This financial promotion is issued by M&G Securities Limited which is authorised and regulated by the Financial Conduct Authority in the UK and provides ISAs and other investment products. The company’s registered office is 10 Fenchurch Avenue, London EC3M 5AG. Registered in England and Wales. Registered Number 90776.

We've been shortlisted for ESG Initiative of the year at the ICA Compliance Awards 2023!

Tenet Compliance Services shortlisted for ESG Initiative of the year at the ICA Compliance Awards 2023!

We’re incredibly proud to announce that Tenet Compliance Services has been shortlisted for the ESG Initiative of the Year at the ICA Compliance Awards 2023, following the successful launch of our digital research tool, ESG Compass.

ESG Compass provides advisers with in-depth research and due diligence on the leading ESG funds, managed portfolio services and mortgages. Free access to this information, bridges the knowledge and confidence gap created by a lack of standardisation and a complex market, empowering advisers to take advantage of the market opportunity.

So, what’s led to us being shortlisted? Let’s have a look at some of our ESG Compass highlights:

- User satisfaction - Users have rated the usefulness of ESG Compass 4.47 out of 5, with 100% of our surveyed users feel more confident making ESG choices for their clients and 93% saying they have recommended to a colleague/friend or would in the future.

- Free to use – We want to ensure that all advisers have equal opportunity to take advantage of our research. This accessibility is especially important for advisers just starting out or for smaller advisers with budget constraints.

- Research approach – All research is conducted by an independent team of industry and ESG specialists, with all the data collected directly from fund houses and managers through detailed in-house due diligence questionnaires - we also perform deep analysis of each provider.

- Uniqueness - Although other research exists for ESG funds, MPS and mortgages, nowhere else can advisers get this level of independent in-depth due diligence on a vast range of propositions all in one place. We aim to combat key barriers and address adviser challenges and skills to empower them to take their first steps into ESG.

Being shortlisted for this award demonstrates how we’re helping to drive innovation and standards across the sector. We can’t wait to attend the awards on April 27th, and we’re sure you’ll join us in wishing our team the very best of luck.

Join our ESG labelling panel webinar - 14th December

Do you think the FCA's planned sustainability labels will help wipe out greenwashing once and for all?

Webinar: Wednesday 14th December, 2pm.

Join our expert panel discussing the likely impacts of the FCA’s proposed new rules on Sustainable Disclosure Requirements (SDR) and Investment Labels. Our lively discussion will draw from opinions across the industry to understand how the new labels will help wipe out greenwashing and the impact the new rules might have on the ESG market as a whole. Our in-house ESG experts Joanne Rigby and Mike Dowsett will be joined by:

• The founder of ESG IFA practice Good Green Money, Haydon Waldek

• Head of Advisory Business Development at EdenTree, Adam Kelly

• Head of Impact Investing at M&G Investments, Ben Constable-Maxwell

Join our webinar to:

1. Gain a better understanding of the new SDR and Investment Label requirements

2. Understand the impact that it will have on greenwashing

3. Recognise challenges involved

4. Gain insight on what different providers will need to consider when implementing the proposed new rules

CPD – 1 hour structured (CII accredited).

Sustainable Disclosure Requirements (SDR) and Investment Labels

The FCA has now published its long-awaited Consultation Paper on Sustainable Disclosure Requirements (SDR) and Investment Labels (CP22/20). The paper outlines several proposals with the overall aim of tackling greenwashing and building consumer confidence in the market for sustainable investment products.

Core to the proposals are three new investment labels which fund providers can choose to apply to products, subject to meeting the specified requirements. The proposed labels are:

- Sustainable Focus – Investing in assets that are environmentally and/or socially sustainable

- Sustainable Improvers – Investing in assets that, while not currently environmentally or socially sustainable, are selected for their potential to become more environmentally and/or socially sustainable over time, including in response to the stewardship influence of the firm

- Sustainable Impact – Invested in assets that provide solutions to environmental or social problems, often in underserved markets or to address observed market failures

Other proposals within the consultation paper include:

- Consumer Facing product level disclosures. These will help consumers to understand the key sustainable features of a product.

- More detailed disclosures at product and entity level. These are aimed at a broader range of stakeholders, including institutional investors.

- Naming and Marketing rules – These include a general anti-greenwashing rule and ensure that sustainability related claims are clear, fair, and not misleading. These rules will also apply some restrictions around the naming of products which do not use a label.

- Requirements for distributors. Distributors including financial advisers and platforms will be expected to provide information on labels and make available the consumer facing product level disclosures. As to assessing suitability, the FCA will explore how to introduce rules for financial advisers in due course.

A Policy Statement containing the finalised rules is expected by June 2023. Investment firms will be granted 12 months from the policy statement to implement the labelling and produce the required product disclosures. This means an expected implementation deadline of 30th June 2024. The Policy Statement will also include specific requirements for portfolio management services wishing to apply a sustainable label.

The market for sustainable investment products has expanded rapidly over recent years. These proposed measures will help consumers and their advisers understand how products are positioned and better facilitate like-for-like comparisons between different investments. The measures will ensure more consistent use of terminology, as well as tackling misleading claims and greenwashing leading to improved consumer confidence.

Overall, the rules are expected to be welcomed by the financial services industry. However, there is still much to understand around how the rules will be implemented, what changes providers may need to make to existing positions and importantly how the advice journey will need to adapt to identify client needs and match them to a product with an appropriate label.

Tenet Compliance Services welcomes the clarification from the FCA on the investment labels and its intent to crack down on greenwashing. Most importantly, standardising the information provided to clients will enable more informed decisions on their investments.

We are here to support advisers with understanding the new SDR and Investment Label requirements and provide guidance on how different investment providers have implemented the new rules. ESG Compass will be updated as the market develops to become a valuable central source of information covering guidance on the the Sustainable Disclosure Requirements, provider obligations, suggested adviser processes and comprehensive comparative data around how investment firms have applied the proposed new labels.

We are very much looking forward to supporting you on this sustainable investment journey.

Tenet invests in ESG digital platform for advisers

ESG Compass to provide in-depth ESG research and analysis in a useful online tool

Tenet, one of the UK’s leading financial adviser support groups, has launched a new research platform, ESG Compass, that enables advisers to cut through the complexity of ESG propositions and make recommendations to their clients based on well-researched information they can trust.

An all-in-one digital portal, ESG Compass gives advisers access to a suite of ESG funds, managed portfolio services, and mortgage research, all subject to comprehensive due diligence, objective analysis, and regular re-evaluation. Furthermore, advisers can conduct focused ESG searches according to criteria such as ESG style, product type, risk level, and cost.

The launch of ESG Compass marks Tenet’s continued investment in technology to support advisers delivering good consumer outcomes. ESG Compass will be available to both Tenet Compliance Service’s directly authorised advisers and the wider market, with Tenet Network Services members also getting access to research as part of their existing panel research.

To celebrate its launch, Tenet is giving free lifetime access to anyone who signs up to ESG Compass before the end of this year.

Mark Scanlon, Chief Executive at Tenet, said: “Rightly, ESG has become an essential consideration for investors seeking a positive impact and healthy returns. However, finding and researching ESG propositions in a saturated market remains complex and time-consuming for advisers. Our new digital platform gives advisers confidence in meeting their clients’ ESG requirements by enabling them to research a range of ESG propositions.”

Joanne Rigby, Technical Director at Tenet, said: “Detailed, accurate, up-to-date due diligence is critical for advisers trying to meet their client’s ESG preferences. ESG Compass provides in-depth research that helps independent financial advisers make more-informed ESG decisions and ensure better outcomes for their clients.”

5 things you need to know about green mortgages

5 things you need to know about green mortgages

The UK’s ambition for a green economy has seen an explosion of new products and services enter the market. One such option now being offered by some mainstream lenders is green mortgages. Here we list 5 things you need to know about green mortgages to help you when having such discussions with clients.

No.1 – What is a green mortgage?

A green mortgage is simply a mortgage that rewards homeowners for purchasing an energy-efficient property or renovating an existing property to make it greener. Lenders are increasingly seeing energy-efficient properties as being less risky purchases, as well as being more likely to hold their value. As such, green mortgages often feature incentives such as lower interest rates, cashback schemes, and increased loan options.

Green mortgages generally fall into 2 categories: those rewarding people for purchasing/living in an energy-efficient home, and those rewarding people for carrying out ‘green’ improvements such as installing solar panels or improving heating systems.

No.2 – How is a property classed as green?

Whether a building is classed as green or not currently depends on its Energy Performance Certificate (EPC) score. An EPC is a document detailing how energy efficient a property is. Valid for ten years, an EPC is required whenever a property is built, bought, or sold.

Graded from A to G, with A being the highest and G the lowest, current statistics estimate 82% of EPC certificates created in the first three months of 2022 had an energy rating of A or B. While this is encouraging, there is still a long way to go to reach the government’s aim of all homes having an EPC rating of at least C by 2035. Estimates suggest that just 10% of homes built before 1900 currently have a rating of C or higher.

EPC ratings for properties in England, Wales, or Northern Ireland can be found here.

EPC ratings for properties in Scotland can be found here.

The following buildings do not require an EPC:

- Places of worship

- Listed buildings

- Residential/holiday home accommodation used less than 4 months a year

- Industrial sites/workshops not using a lot of energy

No.3 – Are green mortgages really green?

Well, yes and no. It’s true that there is nothing actually green about the mortgages themselves. The ‘green’ aspect comes from the fact that lenders are encouraging people to move into energy efficient properties and promoting green upgrades to existing properties. As with ‘normal’ mortgages, people will still borrow money and pay it back in monthly instalments. A green mortgage does not mean the lender will be investing this money in environmentally friendly industries. Of course, the greener properties are, the more positive the impact they will have on our planet’s environment.

No.4 – Do green mortgages offer better value?

Again, the answer is a bit of yes and a bit of no.

“The current reality is that there may well be cheaper mortgage options available than the green mortgages being offered. Due to the restricted number of lenders offering green mortgages, independent mortgage advisors can often find a cheaper mortgage that isn’t a green mortgage product. However, lenders offering green mortgages often do so at lower rates than their standard mortgages. As such, a full review of the mortgage options available in the market must be completed, rather than limiting the search to a comparison between green mortgage products.”

Of course, energy-efficient houses will result in lower energy bills – something very attractive in the current climate. While such reductions are important, from a financial point of view, such energy savings will need to be calculated long-term to provide a more accurate indication of how much money has been saved.

No.5 – Are green mortgages here to stay?

Yes. However, it’s perhaps more accurate to say that instead of more green mortgages appearing, traditional mortgages will likely become greener. Demand for energy-efficient homes is only going to increase, as will laws governing such environmental issues.

One clear indication of this is the recent change to the Minimum Energy Efficiency Standards (MEES) for rental properties in England and Wales. Coming into effect in 2025, the new standards call for new rental properties to have an EPC rating of C or above. As of 2028, this rule will apply to all rental properties. Reflecting the importance the government is placing on this, penalties for landlords without a valid EPC will rise from £5,000 to £30,000 from 2025.

The United Nations Climate Change Conference COP26 took place in Glasgow in November 2021. A key goal of the conference was to achieve global net zero admissions by the mid-century. As such, countries are being asked to put forward plans to achieve ambitious reduction targets by 2030. Pressure to build greener homes in the UK is likely to grow as part of plans to achieve these targets, which in turn should lead to growing interest and further product development in the green mortgage market.

For the latest research, including dedicated green mortgage research, sign up today.

How sustainable is ESG?

How sustainable is ESG?

We look at why the recent boom in ESG fund popularity is here to stay, and how advisers can navigate the challenges of this brave new world.

The popularity of ESG funds has surged in recent years. Salient realities such as the pressing climate crisis and Covid-19 pandemic have raised public awareness of ESG issues, while ESG investment choices have been taken to whole new heights.

Scepticism about whether ESG funds can truly deliver the same returns as their non-ESG competitors seems to have been finally put to bed. Positive impact funds have started to demonstrate they can more than hold their own, if not beat, many of their rivals – with some ESG products becoming a first-choice investment based on performance alone.

All of this, combined with a new generation of ethically conscious investors with easier access to investment products and platforms, has served as a heady tailwind for today’s booming ESG funds industry.

Here to stay

As with any trend though, there is always the fear it is just that – a passing fad. Just how sustainable is the ESG phenomenon?

Thankfully, there’s much to suggest that ESG is far from fleeting and is instead an enduring trend that’s here to stay. Only 13% of investors think ESG will eventually go out of fashion, according to research from Capital Group, while the number of ESG-aligned products coming to market is rising – and fast.

Investment managers everywhere are launching new funds and re-positioning existing strategies, whether with ethical exclusions or for social impact. This is creating an abundance of choice for investors and a large market hungry to receive capital.

Increasing regulation is also indication of a robust future. Stronger scrutiny, standards, and transparency will help root out ESG imposters and reduce problems such as greenwashing and carve out a lasting place for ESG products. Clearer definitions and guidance from the FCA will also help raise adviser and client confidence in ESG funds.

Statistic source: GSIA

Slow down, speedbumps ahead…

However, the ESG sector is not without its dangers. The growth of ESG is undoubtedly a good thing, but this burgeoning sector is still finding its way and there are many questions to be addressed.

The onset of geopolitical tensions and inflationary pressures have laid bare new-found challenges for sustainable funds. The war in Ukraine has recently shaken up the consensus of companies’ ESG credentials, with governance coming under the spotlight more than ever before. Such global issues create new dilemmas for advisers and their clients. For example, can defence stocks, once the bogeyman of any ESG portfolio, now be regarded as having social value because of the protection and deterrence they can bring?

Meanwhile, growth investing tailwinds – which have so far benefited many ESG products – are starting to reverse as inflation proves to be far more than transient. And as the short-term performance of many ESG funds comes under new pressure, past concerns regarding positive impact only coming at the expense of performance could start to re-emerge.

What to tell clients

With all this to consider, what should advisers be telling their clients?

Advisers must stay up to date with the ever-evolving ESG landscape if they want to benefit from this growing sector. Furthermore, advisers must make sure clients aware of the dangers mentioned above. This is not to say ESG should be discouraged – but it’s important clients understand potential pitfalls and nuances, from shifting expectations and greenwashing threats, to how the objectives of ESG product types differ.

Finally, advisers must consider the pros and cons of creating a mixed portfolio. Such diversification enables clients to be exposed to ethical strategies that fit their values, while being protected by the safety blanket of traditional fund solutions.

These conversations can help advisers and their clients arrive at informed decisions that match their individual financial goals, ethical considerations, and risk appetite.

UK investment source: refinitiv

A changing world

From an evolving regulatory environment to a well-stocked supermarket of products, ESG is here to stay and it’s time for advisers to strap themselves in for the long haul.

ESG is not without its challenges, and there’s likely to be more speedbumps along the way as new macro environments and geopolitical realities emerge. But by staying informed of the latest developments and having open, informed conversations with clients, advisers will be able to navigate the changing ESG landscape with greater peace of mind.

Can greenwashing be avoided?

Can greenwashing be avoided?

We explore the growing dangers of greenwashing and what steps advisers can take to better protect themselves and their clients.

Environmental, social and governance (ESG) investing has gone from niche to mainstream. Once just a means of avoiding certain unsavoury industries, ESG has grown into a wide-ranging concept that incorporates many different sectors and values. As such, it is becoming increasingly important for advisers to clearly understand the many different facets of the ESG market.

As the definition of ESG expands and the market grows, one issue receiving a lot of attention is ‘greenwashing’.

Greenwashing is the practice of providing a misleading image of a company or investment product’s ESG credentials. This has resulted in increasing concerns over companies offering purposely incomplete, unsubstantiated, or even false ESG information to disguise bad business practices. The issue is further compounded when fund managers are tasked with constructing portfolios that pool together many different companies in pursuit of a client’s ESG objectives.

The dangers of greenwashing

There are pressing reasons why greenwashing is such a concern. If a product fails to advance the ESG causes it claims to champion, then progress and improvement in these areas will stall. This can lead to a false sense of ‘everything is ok’, and ultimately have very dangerous consequences for the environment and society.

Greenwashing can also have a significant impact on the financial services sector. The Global Financial Crisis left a mark on the industry that isn’t fading quickly. Adding ESG factors to financial products is of course a great way to help the planet and win back public trust. However, if greenwashing is allowed to prevail and ESG found to be anything short of authentic, it could be equally as devastating for the sector’s reputation.

Finally, greenwashing is playing an increasingly important role in the adviser-client relationship. Such investments for clients are often a balance between achieving their ESG values and reaching their investment targets. With advisers having a duty to ensure fair outcomes for clients, it’s vital they can trust ESG funds in order to provide guidance with confidence.

Quality data is the solution

Access to trustworthy information and improved understanding can help both advisers and clients better avoid greenwashing. ESG funds come in all shapes and sizes, from those eliminating ‘problem’ industries such as oil and tobacco, to funds looking to actively improve the planet. It is therefore important for advisers to learn these differences so that they can explain these to their clients.

Not only do advisers need access to ESG research, but they must be able to trust this data. Advisers are recommended to review their fund research processes, including due diligence practices and where ESG data is sourced, to help safeguard ESG data quality.

The evolution of ESG

With the ESG landscape still evolving, it’s important to stay up to date with the latest products, trends, and challenges. ESG regulations are also likely to tighten in the future, with the FCA already beginning to put the sector under greater scrutiny. While improvements in fund standardisation and transparency, as well as guidance from the regulator, are helping to give advisers and clients needed clarity, much more is still required.

While most ESG investment products are well-intentioned, advisers need to stay alert as more and more asset managers reposition and ‘relabel’ their strategies as sustainable. A typical ‘red flag’ for example would be a ‘green’ portfolio containing fossil fuel or gambling companies. In such instances, advisers need to think critically about how such funds justify their inclusion and whether such a portfolio accurately reflects their client’s ESG values.

As demand for ESG products continues to rise, greenwashing is predicted to become a growing problem for advisers. While better regulatory oversight in the future will help reduce greenwashing, advisers for now need to play a leading role in researching the ESG funds they recommend to clients.

If left unchecked, greenwashing has the potential to erode the trust between clients, advisers, and the entire financial advice sector, not to mention cause lasting damage to our society and planet. Whilst daunting, it’s not all doom and gloom. The ESG sector has enormous potential to do good, both in terms of protecting our planet and creating new investment opportunities. Access to quality data that can be trusted will play a vital role in this.