The M&G Sustainable Multi Asset Fund Range – A range of sustainable, multi-asset, risk-targeted solutions

By Maria Municchi, M&G Investments, as part of Tenet Compliance Services Adviser Development Programme

The value and income from the funds’ assets will go down as well as up. This will cause the value of your investment to fall as well as rise. There is no guarantee that the funds will achieve its objective and you may get back less than you originally invested.

Our Sustainable Multi Asset range represents a key suite of funds for us in the UK, in a world increasingly adept to sustainable investment choices. M&G has long recognised that many clients want their investments to go beyond seeking attractive financial returns. They want their savings invested responsibly, and to have the opportunity to participate in making a difference to the world’s future. Tackling the effects of climate change and the desire to improve society for the greater good are increasingly driving the need for sustainable solutions.

Our Sustainable Multi Asset Fund range launched in late 2020 with the aim of furthering these goals by investing across a wide spectrum of asset classes globally. The funds are designed to align financial and sustainable goals; we develop and leverage global asset allocation views to build portfolios that deliver attractive investment returns, aligned with the financial objectives of our clients in line with desired sustainability outcomes.

Away from the investment floor, M&G continues to underline its broader commitment to ESG and sustainability-focused investing as a firm:

- We have pledged to decarbonise our business and set a target to become carbon net zero by 2030.

- We are aiming to reach carbon net zero across our investment portfolios as an asset owner and asset manager by 2050, in line with the Paris Agreement and the UK Government’s own target.

- As a firm, we believe that ESG and sustainable investing criteria are increasingly going to be key drivers of returns for many companies and markets moving forward.

- This isn’t about M&G jumping on the green investing bandwagon; we believe we can harness our skillsets and scale to target investments that can genuinely make a difference to the world.

M&G is increasingly transitioning its fund range to include sustainable outcomes as part of an investment objective, reaffirming the company’s strategic decision to meet our clients’ growing demand for sustainable investment products.

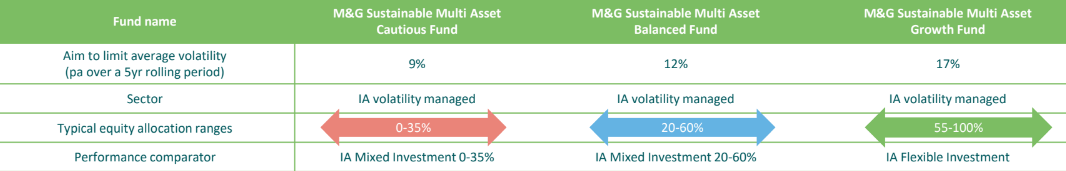

The Fund Range

The funds employ a sustainable investment approach that seeks to generate returns over the long-term while seeking to maintain the volatility of those returns to set ceilings measured over any five-year period. Returns are combination of income and capital growth, achieved through flexible asset allocation and guided by a robust valuation framework.

ESG factors are incorporated into the portfolio construction phase via ESG screens to identify our investable universe. We seek to invest in assets issued by companies or governments that uphold high standards of ESG behaviour.

- As well as seeking investment return, each fund is expected to meet the following non-financial metrics:

o Minimum MSCI ESG rating of A-AA

o Carbon intensity level lower than the MSCI AC World Index

o A ‘positive impact’ assets exposure of between 20 and 50% of NAV. These are companies or institutions that seek to actively address some of today’s big environmental and social challenges alongside their commercial obligations.

Within portfolio construction we adopt a mixture of both long term, top-down asset allocation decisions and a more tactical decisions that seek to exploit mispriced opportunities across asset classes. Macro and sustainability developments, assets behaviour, investor psychology are all examined.

The manager assesses what is considered to be fair value for a wide range of global assets (bonds, credit, equities, real estate, cash, infrastructure) around the world in light of historical expected returns, economic theories and investors’ preferences for each asset class.

This is called ‘neutrality’. She then compares this neutrality with the real yield of these assets to create a robust valuation framework (see chart below). The objectivity and discipline of this analysis helps to prevent the fund manager from falling victim to the very emotional biases she looks to exploit.

Reasons to invest

- As at 31 March 2023, each fund’s MSCI ESG score (covering holdings that are rated by MSCI) was between 7.2 (the Cautious fund) and 8.0 (the Growth fund). This is equivalent to an MSCI ESG rating of AA.

- Well over 40% of fund holdings across the range were classed as ‘positive impact’ assets. Included in this bucket are positions in infrastructure, notably in selected companies focused on renewable energy strategies, as well as other impact assets such as green bonds.

- Geopolitical events in 2022 have hastened the energy transition for many nations as policymakers began work to improve their energy security and diversify their energy sources, putting renewable power firmly on the agenda of many governments and global companies.

- Recent government initiatives such as REPowerEU and the Inflation Reduction Act in the US are directing billions of dollars of funding towards new energy technology and green initiatives.

Risks associated with investing

The main risks that could affect performance are set out below:

Investments in bonds are affected by interest rates, inflation and credit ratings. It is possible that bond issuers will not pay interest or return the capital. All of these events can reduce the value of bonds held by the funds.

The funds are exposed to different currencies. Derivatives are used to minimise, but may not always eliminate, the impact of movements in currency exchange rates.

Investing in emerging markets involves a greater risk of loss due to greater political, tax, economic, foreign exchange, liquidity and regulatory risks, among other factors. There may be difficulties in buying, selling, safekeeping or valuing investments in such countries.

The funds may use derivatives to profit from an expected rise or fall in the value of an asset. Should the asset’s value vary in an unexpected way, the funds will incur a loss. The funds’ use of derivatives may be extensive and exceed the value of its assets (leverage). This has the effect of magnifying the size of losses and gains, resulting in greater fluctuations in the value of the funds.

In exceptional circumstances where assets cannot be fairly valued, or have to be sold at a large discount to raise cash, we may temporarily suspend the funds in the best interest of all investors.

The funds could lose money if a counterparty with which it does business becomes unwilling or unable to repay money owed to the funds.

Operational risks arising from errors in transactions, valuation, accounting, and financial reporting, among other things, may also affect the value of your investments.

Further details of the risks that apply to the funds can be found in the funds’ Prospectus at www.mandg.com/ investments/professional-investor/en-gb/literature.

Sustainability criteria for the range can be found at the following links:

M&G Sustainable Multi Asset Balanced Fund Sterling I Acc